Everyone knows that paying taxes in Italy is notoriously complicated. It’s important to have at least a basic understanding of how to calculate your salary and taxes in order to cope with the cost of living in Italy, especially if you live in one of the major cities. People outside of the European Union imagine that tax in Italy is much higher than, say, those in the United States, but they are much closer than is expected if we take into consideration the high cost of health insurance and the various additional forms of taxes that are paid on goods in the U.S. that are not paid in Italy.

Let’s take a look specifically at personal income taxes.

As of 2020 the average salary in Italy is just over €30,000 with an average hourly rate of €14. This average is expected to grow by about 14% percent by 2025. The Italian tax system is progressive, which means that those earning more in Italy are subject to higher income levels. Income tax and social security contributions are deducted monthly from the gross salary by the employers on behalf of the employees.

Who Collects the Taxes?

When Should I File?

Tax returns can be filed in September and November and there are two methods of making your return. Check out articles about tax deadlines in Italy in 2020 for more info.

First, the 730 which is available to people who are employed by companies and who don’t have a Partita IVA. The 730 model can be done yourself or compiled by an authorised tax agent. In both cases the form is submitted electronically to the tax authorities. The tax payable or receivable is then added to or deducted from the pay slip of the following July and/or November. The other method is the modello Redditi. This tax return can be filed by any taxpayer. The main difference between the modello Redditi and the 730 is that any taxes to be paid have to be done so directly by the taxpayer, or, in the case of a credit, the taxpayer must make a claim to the authorities.

There are three principal taxes to be paid on income in Italy. IRPEF is the individual national income tax to which all individuals are subject. There are also regional taxes which vary from 0.7% to 3.33% and municipal income tax rates which can vary from 0% to 0.9% and depend on where your fiscal residence is.

Additionally, social security contributions are around 9.2% of gross income. Social security (INPS) is mandatory but contributions to it are deducted from your gross income before calculating taxes. Regarding the INPS amount, employers also contribute an additional 28-30%. For those who are self-employed workers the rate of INPS varies between 25% and 29%. Taxes and INPS contributions can be paid in advance. This kind of payment usually involves calculating residual debt or credit from the previous year and then making an advance payment of the current tax year.

So, let’s look at a brief example using a salary of €38,000, but being more precise than the above graph provides for. This puts us in the bracket between €28,001 and €55,000 with a 38% tax rate. So, after the 10% (rounding up for now) for Social Security we’re at €34,200 taxable income (which is how much money can be taxed in this bracket). The National Income Tax here will be €9,315.99, followed by the Regional Tax (Lombardia for this example) of €496.54 and Municipal Tax (at 1%) of €342.00 which brings us to a grand total of €10,154.53 tax due, and leaving us with €24,045.47 net income. These numbers, unfortunately, will vary slightly from year to year.

Check out also our video about this topic for more info, below.

Self-employed Workers

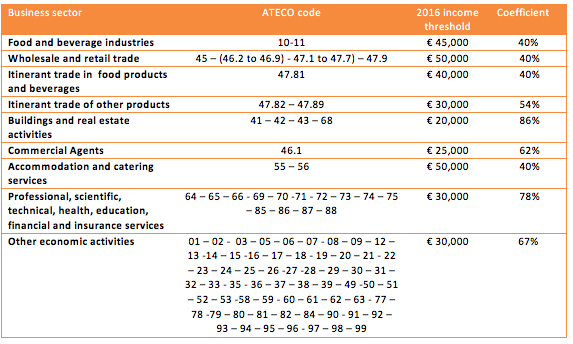

Those who are self-employed are still subject to the same tax bracket as in the graph, but the payment of taxes is slightly different. They can be paid in June, or spread over 6 months from June/July to November and paid in installments. November 30th is the cut off for filing, but it is recommended to file earlier to avoid any potential penalties.

Milan, is considered to be the “working capital” of Italy

A Note for U.S. Citizens

Whether you pay U.S. or Italian taxes on your worldwide income depends on which country you make your fiscal residence. If you live permanently in Italy, and your residence is considered to be your fiscal domicile, you must pay taxes to the Italian government on your worldwide income. You’re considered an Italian resident if you spend more than 183 days each year in Italy.

Living or earning income outside the U.S. does not absolve U.S. citizens of the necessity of filing tax returns. Italy, however, has a double taxation agreement with the U.S, which ensures that you aren’t taxed twice on your income. This also includes Social Security pensions, which are generally subject to the U.S. withholding tax.

Check our video about how to read double tax agreements.

It’s important not to be scared away by all the numbers and to remember that when they are explained, like the monster under the bed, the fear goes away. Such is the price we all pay to live in a beautiful country.

Check out our articles about retiring in Italy from Us, and US pension in Italy.

For more info about INPS check out our video below.